property tax las vegas nv

216 Shadow Ln Las Vegas NV 89106 250000 MLS 2421927 LARGE LOT WITH GREAT LOCATION AND RV PARKING POTENTIAL. Property Tax Cap Video.

The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date.

/cloudfront-us-east-1.images.arcpublishing.com/gray/X3V2BLFPWFD7JBZ5EHJ2AQMNIA.jpg)

. Office of the County Treasurer. Tax amount varies by county. 500 S Grand Central Pkwy.

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. See Results in Minutes. Clark County collects on average 072 of a propertys assessed.

Ad Look Up Any Address in Nevada for a Records Report. To calculate the tax on a new home that does not qualify for the tax abatement lets assume you have a Home in Las Vegas with a taxable. Of the capital gains accrued you would have to pay somewhere between 17000 and 21000 in taxes leaving around 120000 from the sale of the property.

The states average effective. Property taxes in Nevada pay for local services such as roads schools and police. Las Vegas NV 89155-1220.

Apply to Tax Director Tax Manager Partnership Manager and more. Checks for real property. However the property tax rates in Nevada are some of the lowest in the US.

500 S Grand Central Pkwy 1st Floor. Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price.

200000 taxable value x 35. Online access to property records of all states in the US. Overall there are three stages to real property taxation.

Tax District 200. LAS VEGAS KTNV You could be paying more on your property tax than you realize. Las Vegas NV 89106.

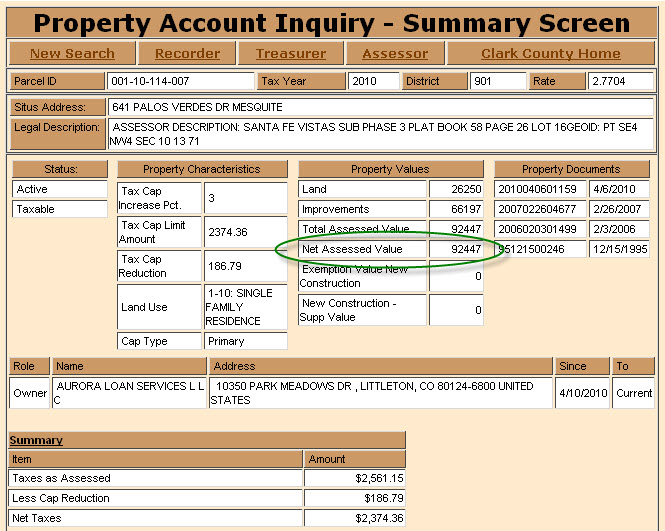

Determine the assessed value by multiplying the taxable value by the assessment ratio. In Nevada the market value. Thoroughly compute your actual property tax including any tax exemptions that you are allowed to use.

CALCULATING LAS VEGAS PROPERTY TAXES. 3 beds 2 baths 1288 sq. Then question if the size of the increase justifies the time and effort it requires to.

084 of home value. What is the Property Tax Rate for Las Vegas Nevada. Download Property Records from the Nevada Assessors Office.

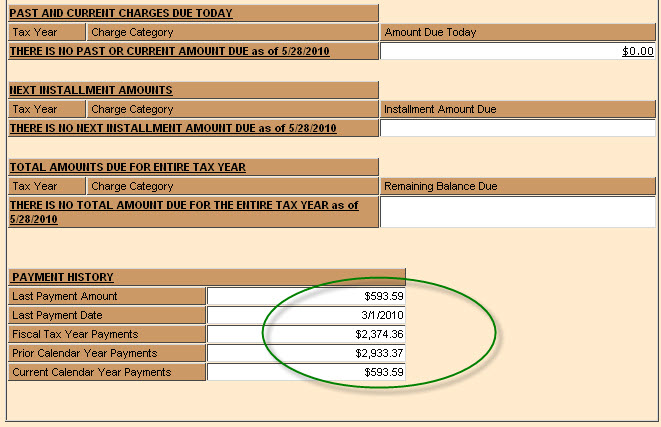

Every municipality then receives the assessed amount it levied. Payments can be made by calling our automated information system at 702 455-4323 and selecting option 1. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Click here to pay real property taxes. Las Vegas NV currently has 3918 tax liens available as of September 9.

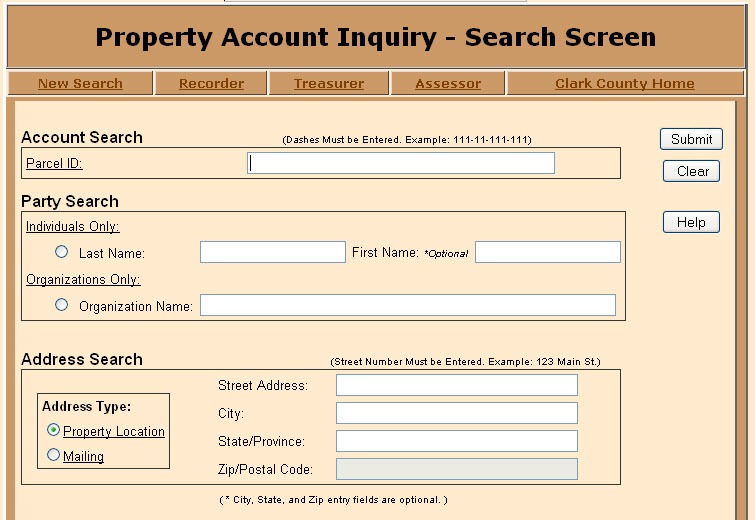

Under state law as a property owner you can apply for a three percent tax cap on. Establishing tax levies evaluating property worth and then collecting. If you are a new visitor to our site please scroll down this page for important information regarding the Assessor transactions.

Tax Rate 32782 per hundred dollars. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300. The Clark County Assessors.

Ad Discover public property records and information on land house and tax online.

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

/cloudfront-us-east-1.images.arcpublishing.com/gray/X3V2BLFPWFD7JBZ5EHJ2AQMNIA.jpg)

Clark County Clarifies Deadline For Homeowners To Update Info To Avoid Higher Property Tax Rate

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Clark County Property Tax Hike Confusion And Frustration Persist Las Vegas Review Journal

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Initial Real Property Tax Bills Mailed To Clark County Residents Las Vegas Review Journal

Clark County Property Tax Hike Confusion And Frustration Persist Las Vegas Review Journal

Clark County Property Taxes Misinformation Addressed By Assessor Las Vegas Review Journal

Mesquitegroup Com Nevada Property Tax

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Property Tax Cap Property Owners In Clarkcounty May Still File A Claim For A Primary Residential Tax Cap Rate Of 3 Percent On Their Taxes For The 2019 2020 Fiscal Year

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Mesquitegroup Com Nevada Property Tax

Nevada Vs California Taxes Explained Retirebetternow Com

Confusion Over Clark County Tax Rate Has Residents Scrambling

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Mesquitegroup Com Nevada Property Tax

Nevada Is The 9 State With The Lowest Property Taxes Stacker